内幕交易主体界定的理论困境与制度重构

打开文本图片集

【中图分类号】D922.287 【文献标识码】A 【文章编号】2095-7009(2025)06-0097-08

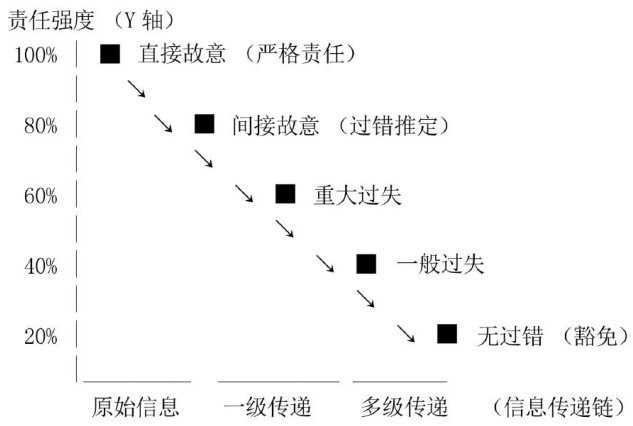

Abstract:Thecurent“identity-conduct”dualregulatorymodelfordefining insider trading subjects in China faces multidimensional dilemmas.Itnotonly involves normativecontradictions atthe legislative level and ambiguityin standards in judicialpractice,but alsoreflects deep-seated divergences in theoretical construction,thus requiring systematicreflection andreconstruction.Theessenceof thisissue liesinthefailure toeffectivelyreconcileconflictsbetween differenttheoretical paradigms andinstitutional logics,making it urgenttointegrate relevant elements toformaunified identification system.By comparing and drawing on theregulatory experienceof the United States,the European Union,and Asian jurisdictions,China can attempt toconstructa“dynamic hierarchical imputation model” to accurately define the boundaries of liability.Meanwhile,relyingon the synergy between legislativereconstructionand the standardizationofjudicial practice, adynamic balance can be struck betwen strengthening legal deterence and maintaining market vitality,therebycreating a more fair and efficient new governance paradigm.

Key words:insider trading; fiduciary duty; theoretical adjustment;dynamic stratification

我国现行证券法律体系对内幕交易主体的规制采用二元规范模式,将责任主体区分为基于主体身份属性的“内幕信息知情人”与基于信息获取手段非法性的“非法获取内幕信息人员”。(剩余11667字)