人民币汇率变动怎样影响通胀率及贸易余额

——一个分位数回归的视角

打开文本图片集

中图分类号:F822.2;F822.5 文献标识码:A 文章编号:1004-0714(2025)07-0065-05

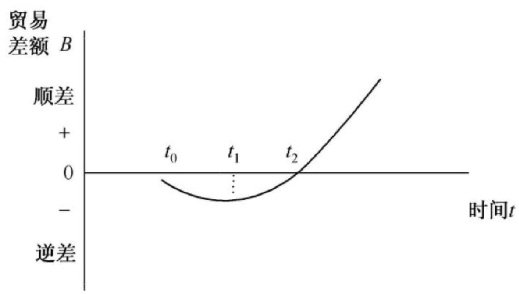

Abstract:Inthe context ofclassicinternational economics underan open economy,exchange rate fluctuations affect a country's inflation rate through channels such as import prices and import substitutes.When a country's exchange rate depreciates,the demand for foreign products shifts towards domestically produced goods,therebyimproving the trade balance raditional inearregression replacestheheterogeneityandextremeconditionsacrossdifferent sectionsofthesampledatadistributionwithaverageconditions.Byusing quantile regression,we can gain aiclearer insight into how fluctuations in the RMB exchange rate affect China'sinflation rate and trade balance.Empirical tests show that the depreciation of the RMB significantlyincreasesdomestic thi ac weakens radually astheinflationraterises,andis notsignificantinthehigherquantilesofinflation. Additionally,the depreciationoftheRMBonly signifi cantly promotes netexportsat thetwotailsofthetrade balance distribution,whilehaving no significant effect in the middle range.

Keywords:Quantile Regression;RMB Exchange RateFluctuations;Inflation Rate;Trade Balance

一、引言

我国历来是一个进口大国,根据海关总署最新发布的进口数据①,2024年1月至8月,我国货物贸易进出口总值达到了28.58万亿人民币,同比增长 6% 。(剩余7270字)