影子银行与货币政策传导探讨

打开文本图片集

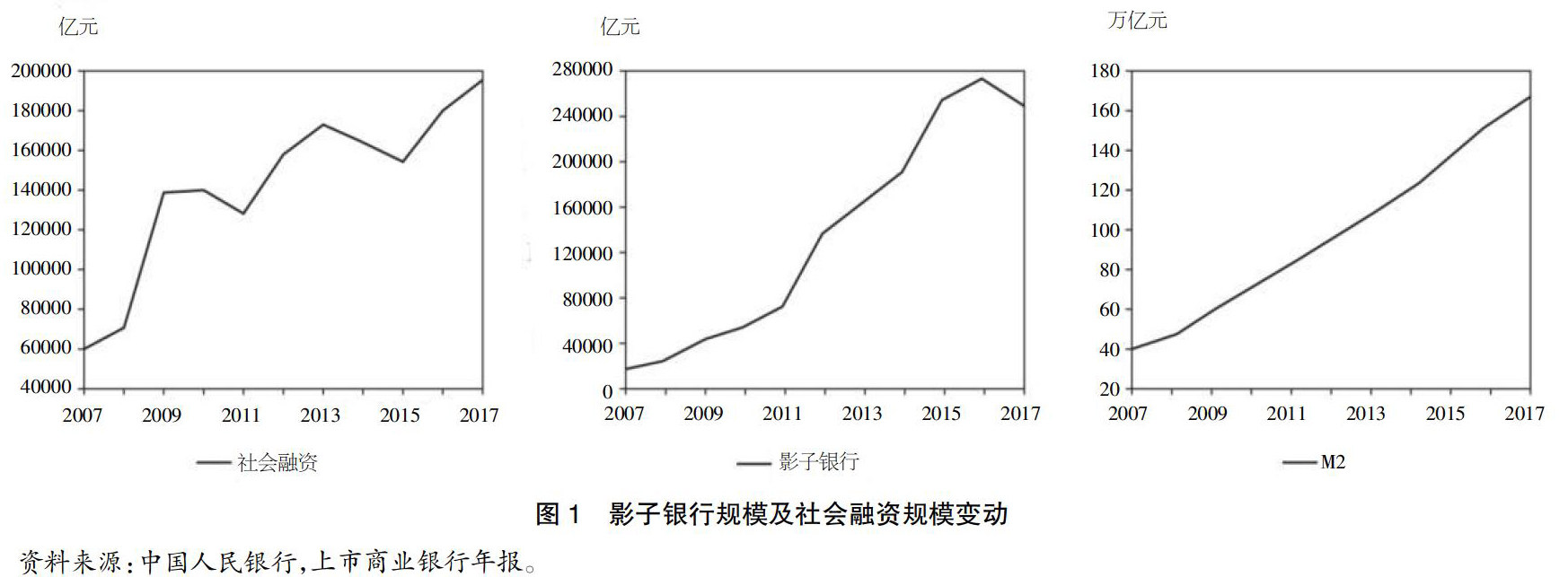

【摘 要】在金融领域,影子银行对金融活动具有重要影响,影子银行因其独具特色的性质,能够对传统融资体系进行充实,同时,对货币政策产生影响,会削弱其有效性。此外,影子银行操控者的特点以及影子银行的相关从业人员等因素会对影子银行产生影响,影响商业银行利率和宏观经济相关问题。

【Abstract】In the field of finance, shadow banks have an important impact on financial activities. Because of their unique nature, shadow banks can enrich the traditional financing system, at the same time, have an impact on monetary policy, which will weaken its effectiveness. In addition, the characteristics of the shadow banks' operators, the relevant practitioners of the shadow banks and other factors will have an impact on the shadow banks, affecting the interest rate of commercial banks and the problems related to macroeconomics.

【关键词】资产管理业务;影子银行;货币政策传导

【Keywords】assets management business; shadow banks; transmission of monetary policy

【中图分类号】F832.3 【文献标志码】A 【文章编号】1673-1069(2021)05-0064-02

1 引言

从广义上来说,影子银行的功能是獨立于银行、给客户提供资金和融资服务的媒介。(剩余2618字)

网站仅支持在线阅读(不支持PDF下载),如需保存文章,可以选择【打印】保存。