信用风险缓释凭证改善了债券发行利差吗?

——来自债券层面的证据

打开文本图片集

键词:信用风险缓释凭证;信用衍生品市场;银行间信用债;债券发行定价;保险效应中图分类号:F832.51 文献标识码:A 文章编号:1007-5097(2025)03-0116-13

Does Credit Risk Mitigation Warrant Improve Bond Issuance Spreads? EvidencefromBondLevel

CHEN Dongjun, SONG Futie

(School of Business,East China University ofScience and Technology,Shanghai 2Oo237,China)

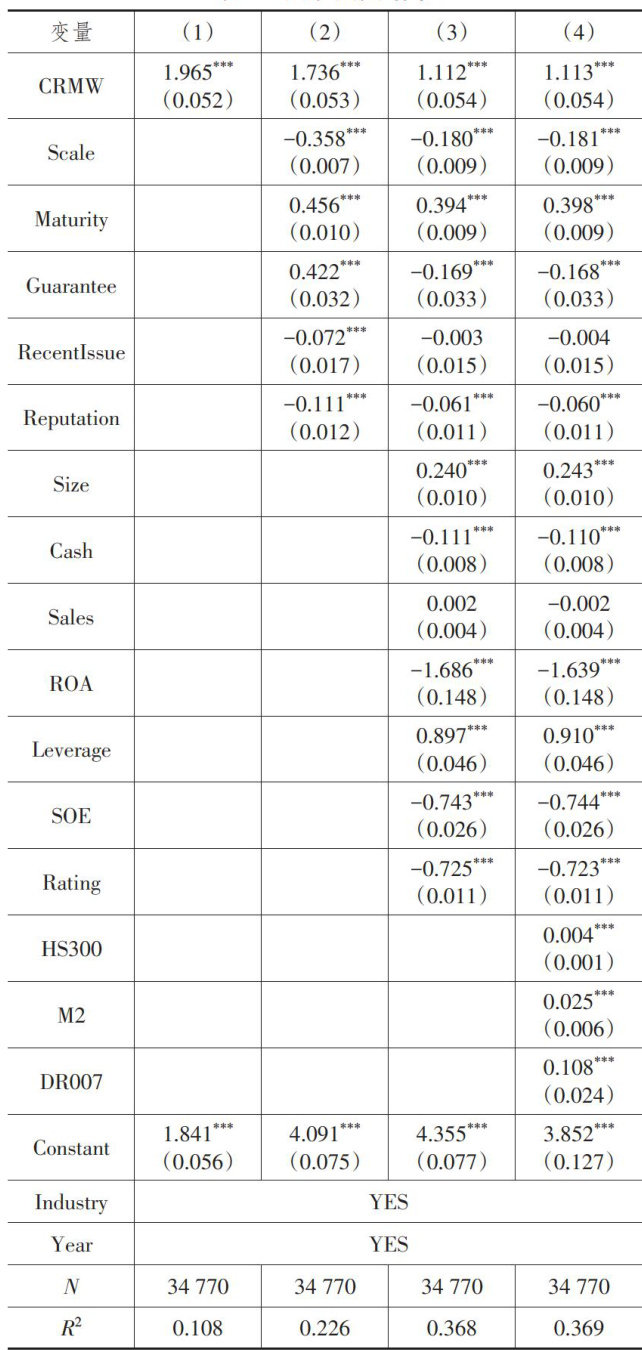

Abstract:Promoting financial services to support thereal economyandasisting enterprises inovercoming financing obstaclesare pivotal undertakings in thedevelopment ofa financial powerhouse.Theessy examines whetherand how creditrisk mitigation warrant (CRMW)afects theissuance spreadsoftheunderlying bonds,usingdatafrom(super)shortterm commercial papers and medium-term notes publicly issed inthe interbank market fromOctober 2018 to December 2023.Research findings: CRMW significantly elevates the financing costs of theunderlyingbonds,aconclusion that remainsvalid after various endogeneityandrobustnesstests.Mechanism testsreveal that,due to the limitations of an immature market,CRMW hasyet to fullachieve its intended insurance efect.While CRMWcontributes to mitigating marketdisagreements,itconcurrently leadstoasignificant increase inboththeminimumand maximumsubscription rates for investors.Theescalation in interest rates atributable to CRMW is particularly pronouncedamong issuers with highcredit level.CRMW iscapable of providing financing supportand substantiallyreducing the issance spreadof underlying bonds only whenthecredit market experiences undersupply and the bond market'scredit risk premium is relativelyelevated.The research findings provideempirical evidence fromemerging marketson the impactof credit derivatives on thebond market.Theseinsights holdsignificant implicationsforthefurtherdevelopmentandimprovement of the credit derivatives market,as wellasforbolstering thebond market's capacity to facilitatecorporate financing.

Key Words:creditrisk mitigation warrant; credit derivatives market; interbank credit bonds;bond isuance pricing; insurance effect

一、引言

2023年中央金融工作会议强调,要着力打造现代金融机构和市场体系,疏通资金进入实体经济的渠道。(剩余19958字)