“保险+期货”模式下的三资产价差期权定价研究

打开文本图片集

中图分类号:F842.6;F832.5;F323.7 文献标志码:A

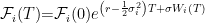

Abstract: Focusing on the pricing of agricultural product profit insurance under the “insurance + futures”model. Based on the log-normal distribution family and the moment matching method,it supplements the three-asset spread option pricing model when the skewness is zero. Through simulation analysis, it explores the impact of relevant factors on option prices and Greek values. At the same time,taking the pig industry as an example,it designs a pig breding profit insurance product. The empirical results verify that the three-asset spread option has a cost advantage in pricing compared with the European option. To a certain extent,this model provides new ideas and tools for the risk management of agricultural product profits.

Key words: three-asset spread options;“insurance + futures";log-normal distribution family; mo ment matching

0 引言

匹配技术的混合拟解析三类。(剩余8969字)