绿色金融对商业银行风险承担的影响分析

打开文本图片集

中图分类号:F832.2 文献标志码:A doi: 10.3969/j .issn.1673-5862.2025.03.013

Analysis of the impact of green finance on the risk-taking of commercial banks

ZHANG Qing, ZENG Yanxi (School of Finance and Trade,LiaoningUniversity,Shenyang1lo8ol,China)

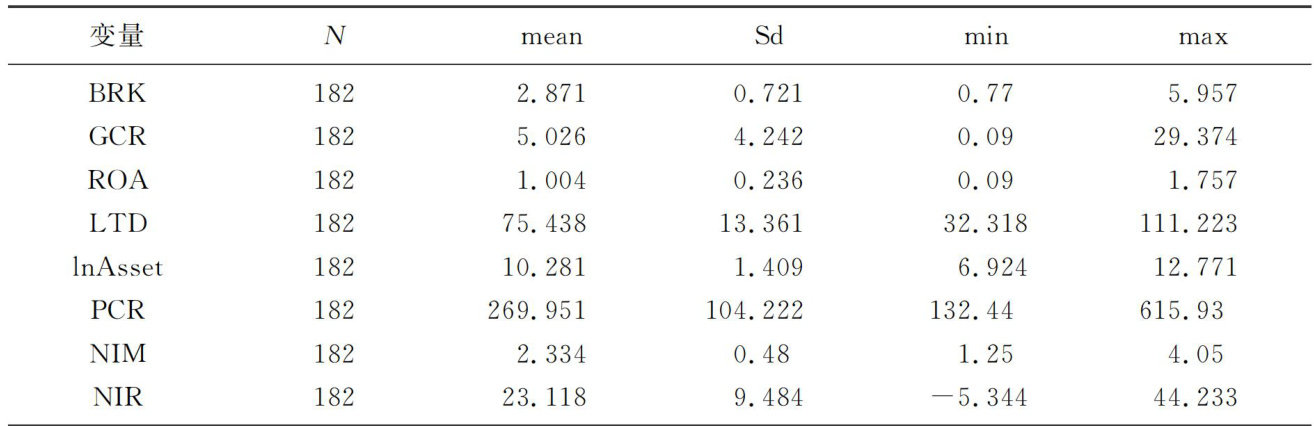

Abstract: Green finance is a critical strategy for commercial banks to leverage financial instruments to promote sustainable economic development. It can reduce credit,compliance,and other risks for commercial banks while enhancing their risk resilience,which is crucial for their stable development.By selecting panel data of 25 representative listed commercial banks in China from 2010 to 2O22 and using a fixed-effects model for empirical analysis,this study deeply explores how green finance afects commercial banks'risk-taking. The results show that green finance can significantly reduce the risk-taking level of commercial banks,and its effect in reducing risk-taking is more pronounced for commercial banks with higher capital adequacy ratios. Based on these findings,policy recommendations are proposed to promote commercial banks to actively engage in green financial services and mitigate risks,including establishing a comprehensive green financial policy system, improving the incentive mechanism for green finance,enhancing green financial risk management capabilities,and strengthening information disclosure in green finance.

Key words: green finance; commercial banks;risk-taking;fixed effects model

在全球气候变化与环境问题愈发严峻的大背景下,发展绿色金融已成为世界各国推进可持续发展的关键手段。(剩余8583字)