碳税政策、银行风险口与宏观审慎监管

打开文本图片集

中图分类号:X196;F812.42;F832 文献标识码:A 文章编号:1007-5097(2025)08-0038-12

Carbon Tax Policies,Bank Risk Exposure,and Macro-Prudential Regulation

CHEN Ruoyu, LI Shuoshi, DING Zhongming (School of Finance,Anhui University of Finance and Economics,Bengbu 233o3o,China)

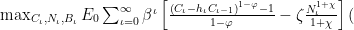

Abstract:How to maintain financial stabilityduring the implementationof carbon tax policies is a practical issue that warrants attention and in-depth research.Thisarticle develops aDSGE model featuring heterogeneous energy sectors and assetquality,characterizes thekeymechanisms bywhich carbon taxpoliciesaffectbank risks,and further explores the efectivenessofmacro-prudentialregulatorypolicies inaddressngbank risks.Research showsthattheimplementationof carbontaxpolicieshassignificantemssonreductioneffects,butitwillaffctthebrownassetvalueofnterprisesthrough marginalcostandassetvaluerevaluation,form strandedaets,lead tonetasst lossesofbanks,and increasebankrisks. Macro-prudentialregulationcan effectivelyreducebank risk exposure,aleviatebankriskscausedbytheimplementation ofcarbontaxpolicies,andplayapolicyroleinmaintainingfinancialstability.Therefore,before theimplementationofthe carbontaxpolicies,itisnecessary to strengthencommunication,form stable market expectationsandsuffcienteconomic adjustment space,inorder toalleviatebank risksand maintain financial stability.

Key words: carbon tax policies; bank risks; stranded assets; macro-prudential regulatory policy

一、引言及文献综述

党的二十大报告明确提出,要防范化解金融风险,守住不发生系统性风险的底线。(剩余16609字)