宏观政策协调与经济发展目标实现

——基于“三元悖论”传统约束与折中化约束的比较

打开文本图片集

Macroeconomic policy coordination and the realization of economic development goals: a comparison between traditional constraints and intermediate constraints based on “impossible trinity”

WANG Yu.wei, FANG Yu.yue

Effective coordination of macroeconomic policies can drive high.quality and sustainable economic growth. This paper constructs a dynamic stochastic general equilibrium model to explore the role of policy coordination in achieving economic development goals under the traditional constraints of the “impossible trinity” and intermediate constraints. Analysis based on China’s economic development practices indicates that under the traditional constraints of the “impossible trinity”, complete capital controls lead to significant imbalances in international trade. Loss of monetary policy independence does not result in significant economic growth, and the phenomenon of international trade imbalances persists. Additionally, free fluctuations in exchange rates only bring negative impacts on economic growth and employment. Under the intermediate constraints of the “impossible trinity”, the study finds that the optimal policy configuration necessitates controlled capital flows, independent monetary policy, and a flexible exchange rate system. This policy mix can concurrently address four macroeconomic objectives. Therefore, compared to the traditional constraints of the “impossible trinity”, this intermediate approach is more suitable for China’s path of economic development. This research provides a theoretical basis for China to promote high.quality economic growth through policy coordination.

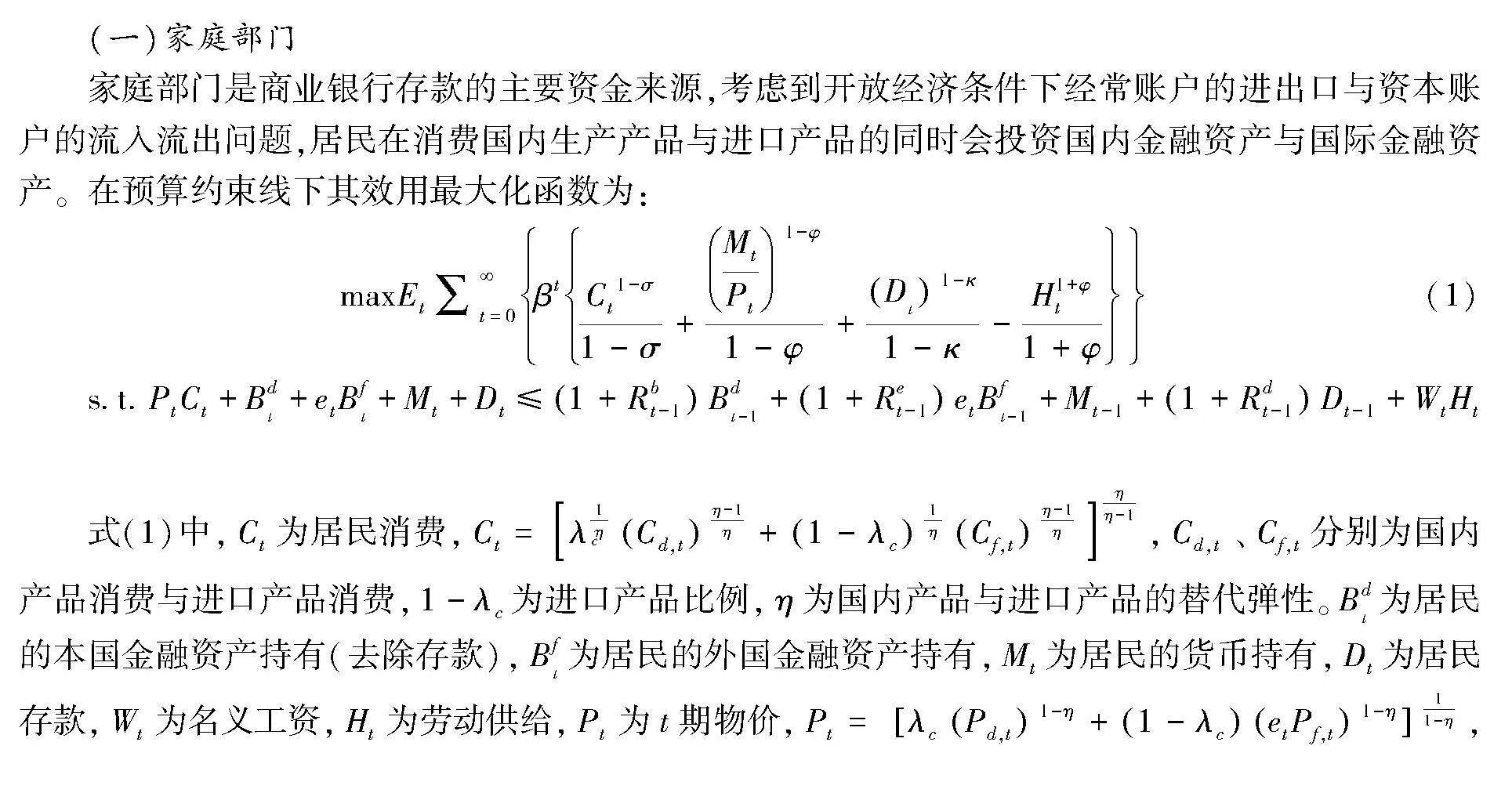

[摘 要] 有效的宏观经济政策协调能推动经济高质量可持续增长。(剩余14972字)