金融安全指数构建及状态识别研究

打开文本图片集

Research on the construction and state recognition of financial security index

LIU Xiao.xing, YANG Guang.yi, ZHANG Ying

As the world is undergoing significant changes unseen in a century, China is facing an increasingly complex financial security environment. In order to safeguard the financial security of our country, it is crucial to minimize the financial security risks. This paper firstly utilizes the TVP.SV.FAVAR model to construct a financial security index. Then through Markov state recognition and time.varying impulse response analysis, the state transition characteristics of the financial security index are revealed, and the mutual influence and response patterns between various dimensions of financial security indices are analyzed. Research finds that: (1) the constructed financial security index can effectively identify tail event shocks and reflect the status and development trends of various dimensions of national financial security indices. (2) The financial security index has significant sustainability under the high regime and the medium zone regime, showing a high steady.state probability under the medium high regime. (3) The impact of various dimensions of financial security indices on financial security has term heterogeneity: in the short term, financial security is largely affected by the positive impact of financial development quality and financial regulatory capacity; in the medium to long term, China’s financial security is mainly affected by financial competitiveness, financial regulatory capacity, and financial stability level.

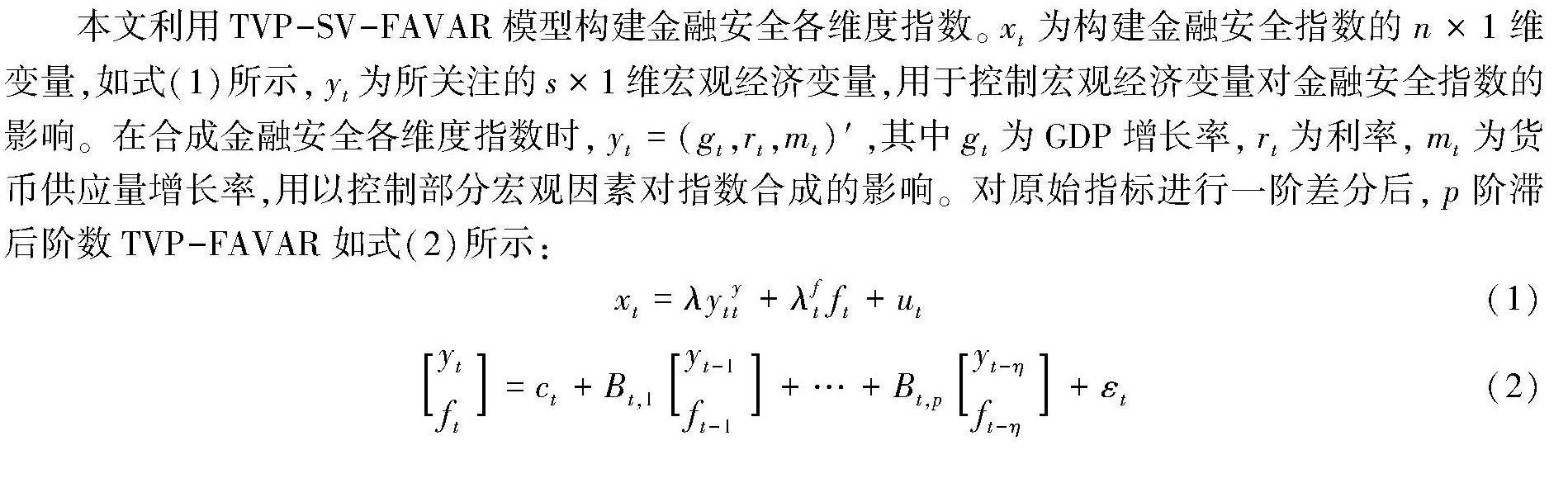

[摘 要] 运用TVP-SV-FAVAR模型构建金融安全指数,通过马尔可夫状态识别与时变脉冲响应分析,揭示金融安全指数状态转换特征,解析金融安全各维度指数间的相互影响及其响应模式。(剩余18587字)